In 2023, the Social Security tax applies to the first $160,200 of net self-employment income. This is quite different from the other retirement plan options, with a bit more complexity to establish. The contributions to be made are calculated based on the benefit you’ll receive at retirement, your age and expected investment returns, but no more than $245,000 for 2022. Contributions are generally tax deductible, and distributions in retirement are taxed as ordinary income. An actuary must figure your deduction limit, which adds an administrative layer.

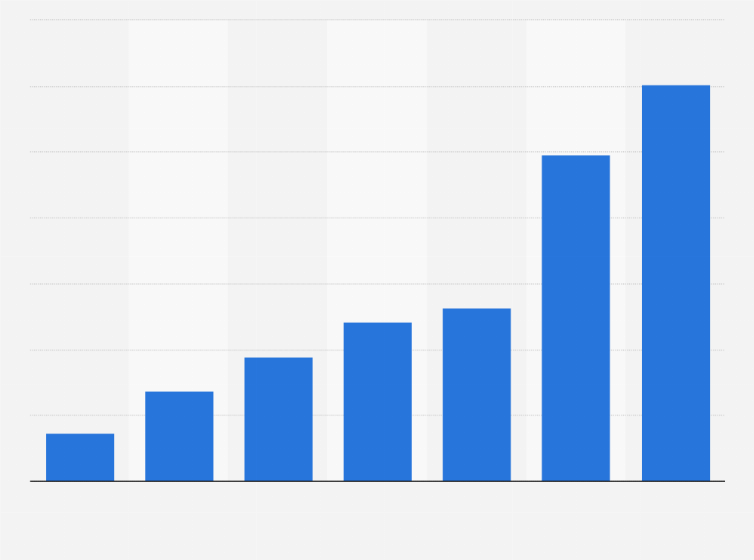

The maximum amount may change annually and has steadily increased over time, reaching $147,000 for the 2022 tax year ($160,200 for 2023). NerdWallet and the IRS both also note that a 0.9% Medicare tax may be added to net earnings that exceed $200,000 for single filers or 250,000 if you file jointly. For 2020, only the first Self employment tax $137,700 will be subject to the Social Security portion of self-employment tax, an increase of the 2019 amount of $132,900.2 Learn more about how to calculate self-employment tax. Instructions for the Self-Employed Payroll Tax Return is listed below to assist taxpayers in completing and understanding the payroll tax.

Annual return

Even if your net earnings from self-employment were less than $400, you still have to file a return if you meet any of the other requirements listed in Form 1040. Don’t forget that without an employer, you will have to do a lot of the tax math to do yourself. If you find yourself overwhelmed or confused by the forms and regulations, you may benefit from professional tax help.

Changes to reporting income from self employment and partnerships – GOV.UK

Changes to reporting income from self employment and partnerships.

Posted: Mon, 31 Jul 2023 07:00:00 GMT [source]

All features, services, support, prices, offers, terms and conditions are subject to change without notice. The IRS will issue you an ITIN if you are a nonresident or resident alien and you do not have and are not eligible to get an SSN. To apply for an ITIN, file Form W-7, Application for IRS Individual Taxpayer Identification NumberPDF. To pay self-employment tax, you must have a Social Security number (SSN) or an individual taxpayer identification number (ITIN). You must pay self-employment tax and file Schedule SE (Form 1040 or 1040-SR) if either of the following applies.

When to pay self-employment tax

Other information may be appropriate for your specific type of business. If you’re newer to self-employment, handling self-employment tax may seem very different from having tax withholdings automatically taken out of your paycheck. And if you have concerns about filing correctly, you can always consult a tax professional. This percentage is split into the tax money that goes toward Social Security and the tax money that goes toward Medicare.

Closing your business? Know which tax returns to file – Ohio Ag Net – Ohio’s Country Journal and Ohio Ag Net

Closing your business? Know which tax returns to file – Ohio Ag Net.

Posted: Sun, 20 Aug 2023 16:40:40 GMT [source]

If this is your first year being self-employed, you will need to estimate the amount of income you expect to earn for the year. If you estimated your earnings too high, simply complete another Form 1040-ES worksheet to refigure your estimated tax for the next quarter. If you estimated your earnings too low, again complete another Form 1040-ES worksheet to recalculate your estimated taxes for the next quarter.

The Self-Employment Tax

Our Block Advisors small business services are available at participating Block Advisors and H&R Block offices nationwide. If you have worked as an employee, you know that what you get in your paycheck is usually less than what you really made. Because your employer withheld money for Social Security, Medicare and income tax and sent that money to the government.

What’s more, it might be possible to claim 50% of what’s owed in self-employment taxes—specifically, the 7.65% employer-equivalent portion of your SE tax—as an income tax deduction. While this doesn’t technically reduce the amount of self-employment taxes, it could potentially save you some money in income taxes. Self-employed persons report their business income or loss on Schedule C of IRS Form 1040 and calculate the self-employment tax on Schedule SE of IRS Form 1040. Estimated taxes must be paid quarterly using form 1040-ES if estimated tax liability exceeds $1,000. The 2010 Tax Relief Act reduced the self-employment tax by 2% for self-employment income earned in calendar year 2011,[7] for a total of 13.3%.

How the Self-Employment Tax Works

Self-employed tax rates are a bit higher than rates employees pay, because self-employed workers’ payments combine both employee and employer contributions. Self-employed workers also pay a rate that combines Medicare and Social Security taxes. This is because employees have Medicare taxes and Social Security taxes withheld from their paycheck by their employer, while self-employed workers need to be responsible for these taxes themselves. As tax season approaches, you might be starting to gather up the materials you’ll need to file your taxes. That’s because a self-employed worker is considered both an employee and an employer. Every self-employed person has to pay self-employment taxes on their self-employment earnings of $400 or more.

In 2022, she was named one of CPA Practice Advisor’s 20 Under 40 Top Influencers in the field of accounting. Her work has been featured in Business Insider, Money Under 30, Best Life, GOBankingRates, and Shopify. Sarah has spent nearly a decade in public accounting experience, and has extensive experience offering strategic tax planning at the state and federal level. In her spare time, she is a devoted cat mom and enjoys hiking, painting, and overwatering her houseplants. You’re also responsible for paying your normal income tax rates in addition to the self-employment tax.

Next, multiply your self-employment taxable income by the 15.3% self-employment tax rate. Once you determine your self-employment tax, you can claim a self-employment tax deduction equal to 50% of your total self-employment tax. Self-employment tax seems high because it encompasses both Social Security and Medicare taxes. And while you would pay only half the amount of taxes as a W2 employee, you are paying the full 15.3 percent (plus federal, state and local taxes) as a self-employed individual. Use the income or loss calculated on Schedule C or Schedule C-EZ to determine the amount of Social Security and Medicare taxes you should have paid during the year.

- IRS Schedule C is used to calculate your net earnings while IRS Schedule SE is used to calculate how much self-employment tax you owe.

- EY is a global leader in assurance, consulting, strategy and transactions, and tax services.

- However, you must pay the 2.9% Medicare part of the SE tax on all your net earnings.

- In fact, you’ll owe tax that you never had to pay as an employee if you made $400 or more in self-employment net income.

When remote working, clearance may sometimes be required from the local authority to use part of the home as business premises. If the self-employed person holds records of customers or suppliers in any electronic form they are required to register with the Information Commissioner’s Office. Other legal responsibilities include statutory public liability insurance cover, modifying premises to be disabled-friendly, and the proper recording and accounting of financial transactions.

Enter your income from self-employment and your tax filing status into the calculator above to estimate your tax. Self-employment tax helps fund programs like Social Security taxes and Medicare taxes. While full-time employees also pay taxes to support these programs, they split the 15.3% tax rate with employers as part of the Federal Insurance Contributions Act (FICA).

If the result is less than the Social Security wage base, the calculation is simple. If your net earnings are more than the Social Security wage base, your calculation will have a few additional steps. You can use our free self-employment tax calculator otherwise we’ll show you how to calculate your tax either way.

Find out everything you should know about mortgage interest deduction. It’s possible to earn both self-employment income and income from a full-time job in the same year. Many people today work both full-time for an employer and run a side hustle.

EY is a global leader in assurance, consulting, strategy and transactions, and tax services. The insights and quality services we deliver help build trust and confidence in the capital markets and in economies the world over. We develop outstanding leaders who team to deliver on our promises to all of our stakeholders. In so doing, we play a critical role in building a better working world for our people, for our clients and for our communities.