The stock has fallen by -1.51% since the beginning of the year, thereby showing the potential of a further growth. This could raise investors’ confidence to be optimistic about the RLJ stock heading into the next quarter. 4 Wall Street equities research analysts have issued “buy,” “hold,” and “sell” ratings for RLJ Lodging Trust in the last twelve months.

The company’s stock has been forecasted to trade at an average price of $13.79 over the course of the next 52 weeks, with a low of $10.50 and a high of $18.00. Based on these price targets, the low is -0.67% off current price, whereas the price has to move -72.58% to reach the yearly target high. Additionally, analysts’ median price of $14.00 is likely to be welcomed by investors because it represents a decrease of -34.23% from the current levels. REITNotes uses the REIT’s Funds From Operation (FFO) per diluted share informed in the REIT’s Quarterly Earning Reports and its announced dividend per diluted share.

Dividend Strength

Analysts have estimated the company’s revenue for the quarter at $359.88 million, with a low estimate of $353.43 million and a high estimate of $373.21 million. According to the average forecast, sales growth in current quarter could jump up 8.90%, compared to the corresponding quarter of last year. Wall Street analysts also predicted that in 2024, the company’s y-o-y revenues would reach $1.32 billion, representing an increase of 10.50% from the revenues reported in the last year’s results. These forward-looking statements generally are identified by the use of the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “plan,” “may,” “will,” “will continue,” “intend,” “should,” “may,” or similar expressions. Except as required by law, the Company undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise. High-growth stocks tend to represent the technology, healthcare, and communications sectors.

Buffett Says Be A Long-Term Investor: 2 Dividends To Hold Forever – Seeking Alpha

Buffett Says Be A Long-Term Investor: 2 Dividends To Hold Forever.

Posted: Thu, 23 Mar 2023 07:00:00 GMT [source]

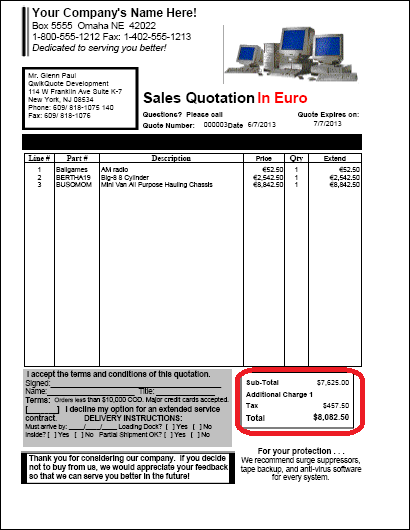

Below are the FFO amounts, dividends, and payout ratios for the last two quarters for RLJ. RLJ Lodging Trust’s stock is owned by a number of retail and institutional investors. Top institutional shareholders include Nordea Investment Management AB (0.20%) and BTC Capital Management Inc. (0.02%). Insiders that own company stock include Nathaniel A Davis and Patricia L Gibson.

Cash Flow Quarterly

The company is scheduled to release its next quarterly earnings announcement on Thursday, August 3rd 2023. Below is a simulation of how much money you would have made in dividends, and how much the shares would be worth had you purchased them 1 year ago for the amounts below. REITRating™ is REITNotes’ Real Estate Investment Trust industry-specific rating and ranking system. The overall score is out of ten points, with ten being the best score.

Indexology: REITs Vs. The S&P 500 – Seeking Alpha

Indexology: REITs Vs. The S&P 500.

Posted: Wed, 28 Dec 2022 08:00:00 GMT [source]

Click the link below and we’ll send you MarketBeat’s list of seven stocks and why their long-term outlooks are very promising. To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research. Our Quantitative Research team models direct competitors or comparable companies

from a bottom-up perspective to find companies describing their business in a

similar fashion. Upgrade to MarketBeat All Access to add more stocks to your watchlist.

What is RLJ Lodging Trust Registered Shs of Benef Interest’s stock style?

However, medium term indicators have put the stock in the category of 50% Sell while long term indicators on average have been pointing out that it is a 100% Sell. RLJ Lodging Trust issued an update on its second quarter 2023 earnings guidance on Thursday, May, 4th. The company provided earnings per share (EPS) guidance of $0.51-$0.57 for the period, compared to the consensus estimate of $0.32. A comparison of RLJ Lodging Trust (RLJ) with its peers suggests the former has fared considerably weaker in the market. RLJ showed an intraday change of 1.26% in last session, and over the past year, it shrunk by -3.92%%. In comparison, DiamondRock Hospitality Company (DRH) has moved higher at 0.62% on the day and was up 1.12% over the past 12 months.

There are currently 2 hold ratings and 2 buy ratings for the stock. The consensus among Wall Street equities research analysts is that investors should “moderate buy” RLJ shares. Revisions could be a useful indicator to get insight https://currency-trading.org/cryptocurrencies/electroneum-price-prediction-2020-2022-2025-2030/ on short-term price movement; so for the company, there were no upward and no downward review(s) in last seven days. We see that RLJ’s technical picture suggests that short-term indicators denote the stock is a 50% Sell on average.

NYSE: RLJ

On average, they predict the company’s share price to reach $14.60 in the next twelve months. This suggests a possible upside of 45.0% from the stock’s current price. View analysts price targets for RLJ or view top-rated stocks among Wall Street analysts. Nearly 0.20% of RLJ Lodging Trust’s shares belong to company insiders and institutional investors own 95.70% of the https://trading-market.org/11-best-online-brokers-for-stock-trading-of-march-2021-2020/ company’s shares. The data on short interest also indicates that stock shorts accounted for 11.81 million shares as on Jun 14, 2023, resulting in a short ratio of 6.49. According to the data, the short interest in RLJ Lodging Trust (RLJ) stood at 7.42% of shares outstanding as of Jun 14, 2023; the number of short shares registered in May 14, 2023 reached 8.93 million.

Maintaining independence and editorial freedom is essential to our mission of empowering investor success. We provide a platform for our authors to report on investments fairly, accurately, and from the investor’s point of view. We also respect individual opinions––they represent the unvarnished thinking of our people and exacting analysis of our research processes.

This is because although paid in Q3, the dividend value is usually declared during the previous quarter. FFO is a non-GAAP measure recognized by the SEC and provided by the REITs as a supplemental measure of their operating performance. FFO is not meant to be an indicator of the REIT’s capacity to pay current or future dividends nor to be a substitute to the REIT’s cash flow from operations.

Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive. RLJ’s beta can be found in Trading Information at the top of this page. A stock’s beta measures how closely tied its price movements have been to the performance of the overall market. Style is an investment factor that has a meaningful impact on investment risk and returns. Style is calculated by combining value and growth scores, which are first individually calculated.

- Below are the FFO amounts, dividends, and payout ratios for the last two quarters for RLJ.

- It is recommended to check the REIT’s website, Earning Reports and dividend announcements for the latest and updated information.

- Below is a simulation of how much money you would have made in dividends, and how much the shares would be worth had you purchased them 1 year ago for the amounts below.

- REITNotes™ calculates the payout ratio by dividing the dividend value paid during the current quarter by the FFO declared in the previous Quarter.

- FFO is not meant to be an indicator of the REIT’s capacity to pay current or future dividends nor to be a substitute to the REIT’s cash flow from operations.

Referring to stock’s 52-week performance, its high was $13.47, and the low was $9.27. Furthermore, the report provides a roadmap for the future, including setting a target to reduce overall carbon emissions by 35% by 2030. Data are provided ‘as is’ for informational purposes only and are not intended for trading purposes. Data may be intentionally delayed pursuant to supplier requirements.

They rarely distribute dividends to shareholders, opting for reinvestment in their businesses. More value-oriented stocks tend to represent https://day-trading.info/10-best-data-management-tools-for-medium-to-big/ financial services, utilities, and energy stocks. 4 brokers have issued 1 year price objectives for RLJ Lodging Trust’s shares.

- This represents a $0.32 dividend on an annualized basis and a yield of 3.18%.

- RLJ Lodging Trust is a self-advised, publicly traded real estate investment trust that owns primarily premium-branded, high-margin, focused-service and compact full-service hotels.

- We see that RLJ’s technical picture suggests that short-term indicators denote the stock is a 50% Sell on average.

- Top institutional shareholders include Nordea Investment Management AB (0.20%) and BTC Capital Management Inc. (0.02%).

- RLJ showed an intraday change of 1.26% in last session, and over the past year, it shrunk by -3.92%%.

- Analysts have estimated the company’s revenue for the quarter at $359.88 million, with a low estimate of $353.43 million and a high estimate of $373.21 million.

3 Tiny Stocks Primed to Explode

The world’s greatest investor — Warren Buffett — has a simple formula for making big money in the markets. For stock market investors that means buying up cheap small cap stocks like these with huge upside potential. We’ve set up an alert service to help smart investors take full advantage of the small cap stocks primed for big returns. © 2023 Market data provided is at least 10-minutes delayed and hosted by Barchart Solutions.